Op-Ed: E-Commerce Adds Choices, Competition & Complexity to Crop Input Sector

By Dan Manternach, Ag Economist & Author

October 15, 2020

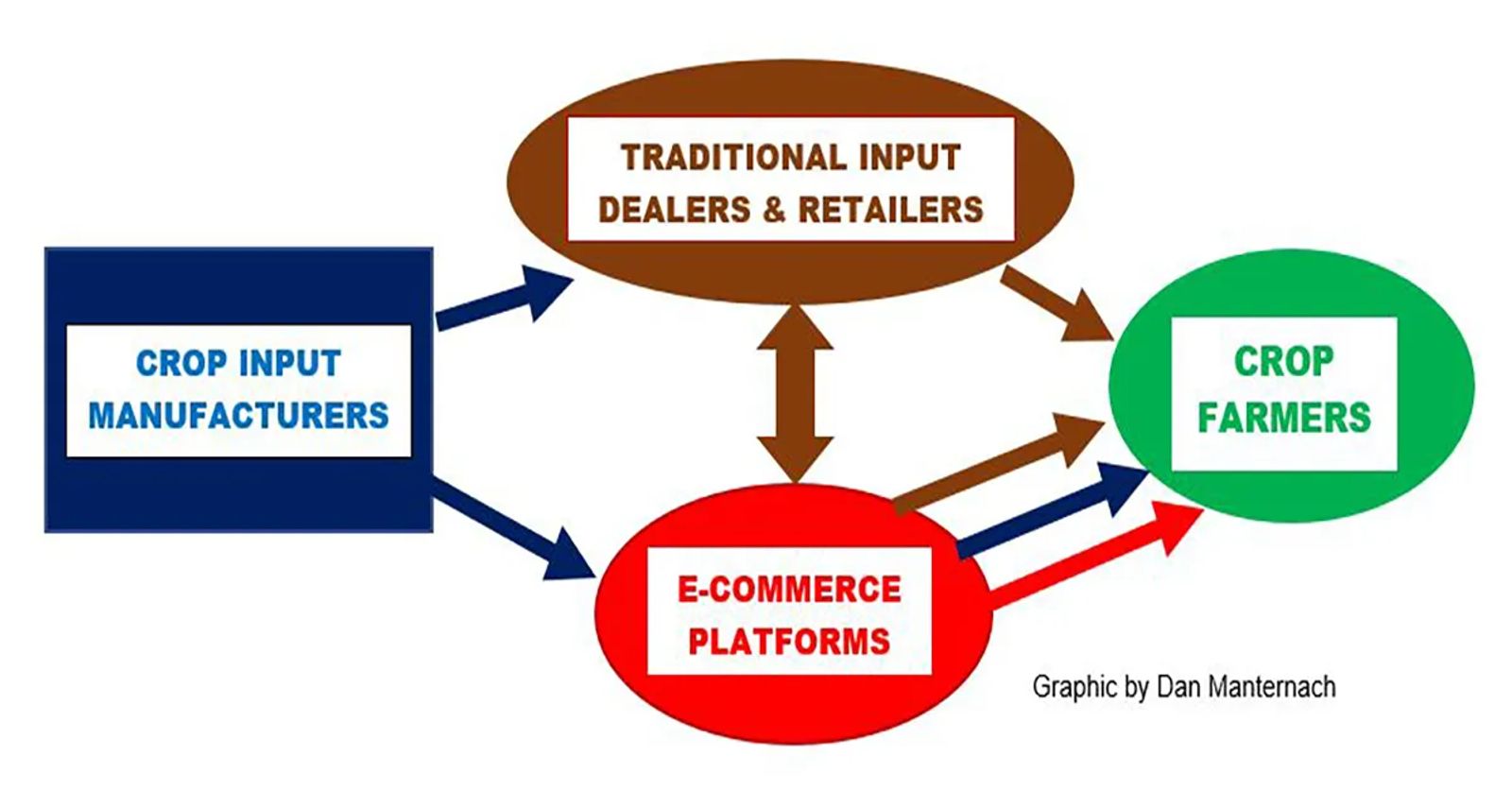

The newest ag megatrend unfolding is e-commerce; particularly in the crop input sector. This year, concern about contracting (or spreading) COVID19 has only accelerated promotion, interest and use of e-commerce for purchasing among farmers. In a September 2020 report, Purdue's Dr. Scott Downey, Director and Professor; Dr. Michael Boehlje, Distinguished Professor Emeritus, and Dr. Luciano Thome e Castro, International Adjunct Professor, found three distinct categories among ag e-commerce platforms: 1) Retailer-to-farmer online only (no physical presence), 2) Manufacturer-to-farmer direct online sales, and 3) The retailer-farmer omni-channel experience (both online and physical presences).

The 1998 trailblazer was XSAg.com; now FarmTrade.com. There were no brick-and-mortar facilities or inventory involved. Founder Fulton Breen of XSInc. described their XSAg.com division as "a secure trading platform to facilitate transactions between buyers and sellers of herbicides, pesticides and other inputs at discounts averaging about 20%." Then, in 2013, he decided to focus on XSInc's data analytics services and divest itself of the XSAg platform. To his great satisfaction, the buyer was one of his long-time employees, Jeff Stow, who renamed the business FarmTrade.com to avoid confusion with Breen's XSInc ag analytics business.

"We are still a family business," says Stow, "and we've only enhanced the name-your-price approach for buyers with our unique 'Dutch auction' approach. Instead of sellers offering prices they'll take; on our site, buyers offer prices they'll pay. They wait until a seller meets their offer and we make a small commission; simple as that." Stow adds,"We even hold the buyer's money in escrow until they take delivery; eliminating that element of risk for all of us involved."

Farmers Business Network (FBN) launched in 2014, with a former Google exec at the helm and has attracted $571 million in capital. They are seen by some as a threat to disrupt ag retailing the way Amazon.com has turned malls into ghost towns. Brick-and-mortar ag retailers feel pressured to adopt the "if you can't lick 'em, join 'em" response to the impending migration to e-commerce on their own websites. Alas, many are finding there's little or no margin left for them when farmers are finding input costs at or below what manufacturers are charging the ag retailers as "middlemen"!

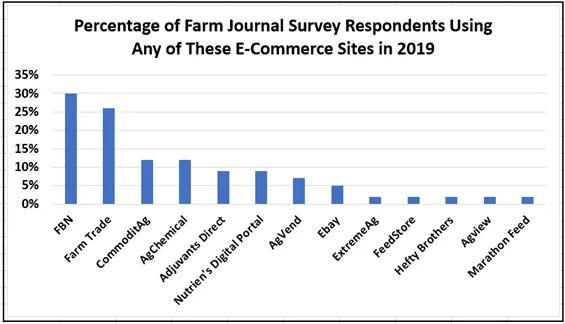

Between XSAg.com (now FarmTrade.com) and FBN, other e-merchants have emerged. In fact, Farm Journal magazine began surveying farmers with at least 500 acres of corn on their use of e-commerce sites in 2018. The most recent data is from the 2019 survey compiled last November. Farm Journal's Margy Eckelkamp cited three key take-aways:

1) Farmers' purchase intentions tend to exceed what they actually do online.

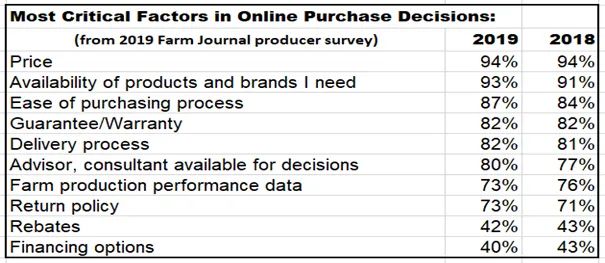

2) Their experience drives their online purchase decisions, with price the number one factor, followed by availability of products, ease of the purchasing process, the delivery process and consulting available for specific questions.

3) Online purchases vary by input category. Highest interest is for crop chemicals (63% in 2019 with indications this would jump to 75% for 2020); followed by seed (42%); then fertilizer (19%).

When Farm Journal asked farmers to list online retailers they use, 14 different e-commerce sites were mentioned among nearly 400 respondents from 36 states and are shown below.

Most noteworthy to me is that despite its enormous capital infusions, relentless promotion and offering the entire array of ag input products, FBN is still only slightly higher in percentage of farmers using it than FarmTrade.com, which specializes in crop protection inputs only.

FarmTrade's Stow says "When we purchased the XSAg business in 2013, we were excited about our new direction and value proposition, but didn't expect the success we've had since our very first year." When asked to explain why, Stow says "it's a combination of earning intense customer loyalty, the word-of-mouth referrals we get from them, and attracting channel members (vendors) with the hottest input products."

That 2019 Farm Journal farmer survey also reported the most important factors farmers consider in choosing e-commerce over their regular ag retailer here:

.png?fit=outside&w=1600)

Stow says those top influences in Fig. 2 are right in line with their own experience at FarmTrade and have guided their own site development. I've also learned consultants to traditional brick-and-mortar retailers feeling threatened by e-commerce are telling them not to count on the "personal, face-to-face relationship with their sales people" to immunize them from the lure of e-commerce competitors. Why? Among the Gen X, Gen Z and Millennial generations of farmers, brand and dealer loyalty are a distant second to saving time and money.

Some consulting firms are even advising ag retailers to do a careful cost analysis for the extra services they "bundle" with their input sales to "justify" prices for inputs to the farmer. One put the reasoning starkly and bluntly: "I tell them that if they couldn't charge for those perks and services a la carte on an invoice, they ought to stop offering them, save the cost, and trim their input prices instead to compete with these aggressive, penny-pinching e-commerce platforms."

The consensus among those focused on the future of ag retailing say it will always demand price competitiveness for crop inputs. They add it will create the opportunity to charge for actionable analytics using the farmer's precision ag data as a separate profit center. Others I monitor predict the next megatrend driving such analytics will be incorporation of Artificial Intelligence (AI) with the farmer's precision ag data. It will churn out the the most profitable prescription on a field-by-field basis in a matter of minutes. But that's grist for another article on another day!

Editor’s Note: Author and Ag Economist Dan Manternach is President of Perfect Fit Presentations LLC, St. Louis, MO.